UK hotel recovery continues in July

The UK continued to display strong hotel performance in July, with some positive signs beginning to show in London.

As the UK further eased Covid- restrictions this week, we take a look back at July’s hotel performance with every sign pointing to trading over the peak summer months of June, July and August expected to out-pace summer 2019. The uncertainty of foreign travel and the ability of UK hotels to welcome guests without restrictions is continuing to drive leisure demand.

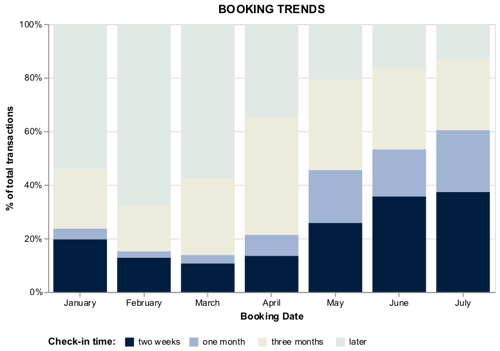

BOOKING TRENDS

For UK leisure hotspots, last month saw a surge in bookings/transactions with 60% of July bookings made for stays within 30 days. The pandemic has shifted guest behaviour towards much shorter booking windows. Lead times were at their shortest since January 2021.

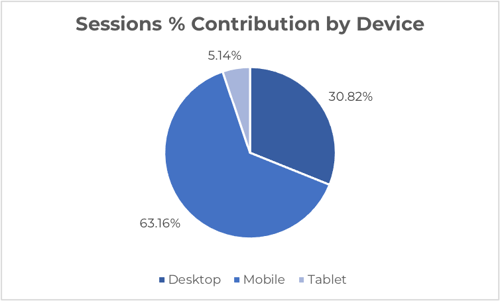

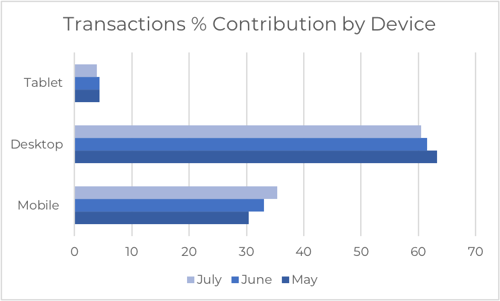

While shorter lead times make life harder for revenue managers, it’s even more important to interpret your own guest booking patterns. Understanding who is booking and when can help you stagger marketing campaigns to reach different target audiences via different channels. Mobile continued to dominate browsing in July with a 2% increase overall in mobile sessions between May and July. Mobile sessions represented a total of 63.16% for UK Hotels in July.

As the share of transactions made on mobile devices continues to grow, ensuring that your guests can easily make and pay for hotel stays on a mobile device is vital to capturing some of this lucrative last-minute business. Transactions made on a mobile device for UK hotels increased by 5% between May and July 2021.

LONDON SHOWING POSITIVE SIGNS

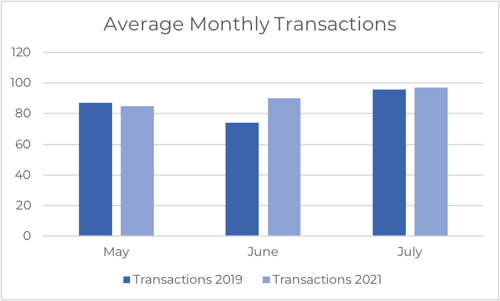

While London may still be missing international travellers and monthly website revenue still behind that of 2019, between May and July, average website revenue increased by 23%.

And when looking at average number of transactions for London hotels, the picture was also positive. Summer transactions between May and July, 2021 are close to or better than 2019 with August also on track to outperform August 2019.

The Hotel Benchmark community has hotels in 64 countries worldwide. If you would like to begin benchmarking your direct channel alongside other hotels in your city or region, sign-up here and start receiving your free reports.

Categories:

Katrina has been working in the hospitality industry since 1993, more recently at Hotel Benchmark, uncovering insight from a wealth of data.